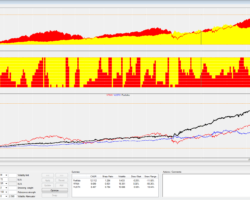

20 years Strategy backtest of our Universal Investment Strategy

This strategy backtest uses the Vanguard VFINX/VUSTX index funds as a proxy to the SPY/TLT ETFs. With these Vanguard funds I have made a 20 year backtest for the UIS strategy. 20 years Strategy backtest of our Universal Investment Strategy I made this strategy backtest, because many subscribers asked for it, and because with these two Vanguard funds, this is also one of the only strategies which can be backtested for such a long period. In … Read more