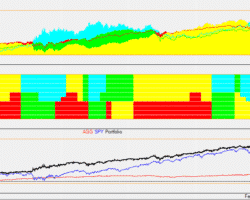

A Global Market Rotation Strategy with an annual performance of 41.4% since 2003

The following ETF strategy is one of my favorite rotation strategies, which many of my friends, customers and I use now for some years. The Global Market ETF Rotation Strategy (GMR) The GMR Strategy switches between 6 different ETF on a monthly basis. The back tested return of this strategy since 2003 is quite impressive. Annual performance (CAGR) = 41.4% (S&P500=8.4%) Total performance since 2003 = 3740% (S&P500=134%) 69% of trades have positive return versus … Read more