Hedging Portfolio: Comparison of TMV, TMF or EDV

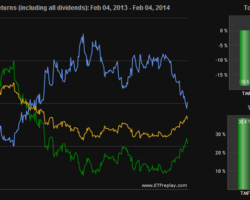

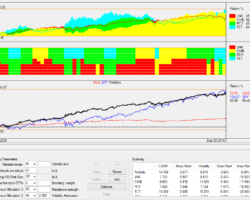

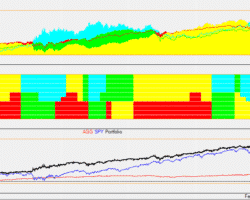

TMF is by far not so good as TMV short for hedging portfolio. Here is the 12 month comparison. While all treasuries had quite big losses of about -7%, a shortTMV position was flat over the year. I think for IRA accounts the better and saver way of hedging would be a part of the investment in the Bond rotation. This one should make 10-15% per year and is also good for hedging portfolio. Hedging … Read more