The World Country Top 4 ETF rotation strategy – A way to fight rising rates and a stalling US stock market

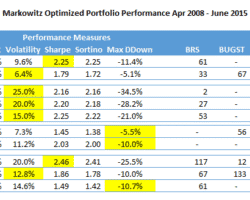

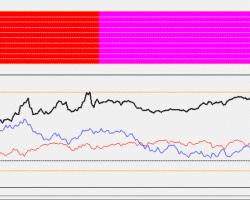

Summary of World Country Top 4 ETF rotation strategy • The World Country Top 4 ETF rotation strategy is a strongly momentum driven strategy creating high returns. • The strategy profits from a maximum global diversification. • With a 20-year CAGR of 20.7% the strategy has a much lower volatility and lower risk than an S&P 500 investment. In my last articles I described various momentum ETF rotation strategies with variable allocations using our maximum Sharpe … Read more