In the follow up to our webinar about how to compose top performing ETFs strategies among the QuantTrader community last weekend, we received many interesting questions and ideas to follow up. One question in particular I´d like to share in a post, as it involves all our “All Strategies” subscribers.

John L. asks: “Using a simple meta strategy by choosing the top two strategies from the previous month (from the monthly newsletter), and investing in them the next month (repeating that each month). I wonder if that can be backtested and compared to past 3 months or a static meta strategy. Perhaps comparing the top 2 each month strategy to the choosing the top 2 from the last 3 months. And comparing the top 2 each month or 3 months to a static strategy of the top 2 – 4 over the full backtest period or past 5 or 10 years.”

So in other words, what´s the best way to pick from the Top Performing ETFs Strategies of the last months, and allocate equal amount of money among them? We publish the performance of all our strategies monthly in a handy ranking table, so it´s easy to pick each month the best performers of the last months, and repeat this throughout the year.

The idea is appealing, as it is an enhancement from our Portfolio Builder Approach, where we apply modern portfolio theory to assemble a fixed weighting portfolio based on the historical performance and co-variance between the strategies. By modifying this to a momentum style “strategy picking” of top performing ETFs strategies we react to changes in the market and therefore overcome one of the critiques MPT receives frequently.

Top Performing ETFs Strategies in one Portfolio

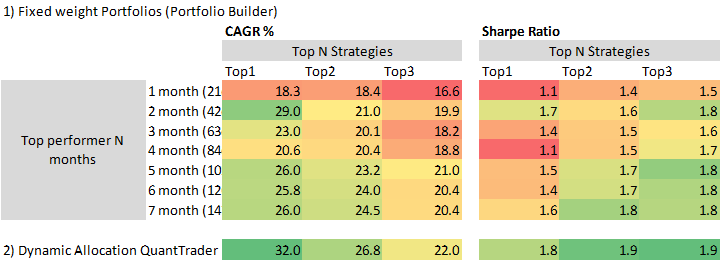

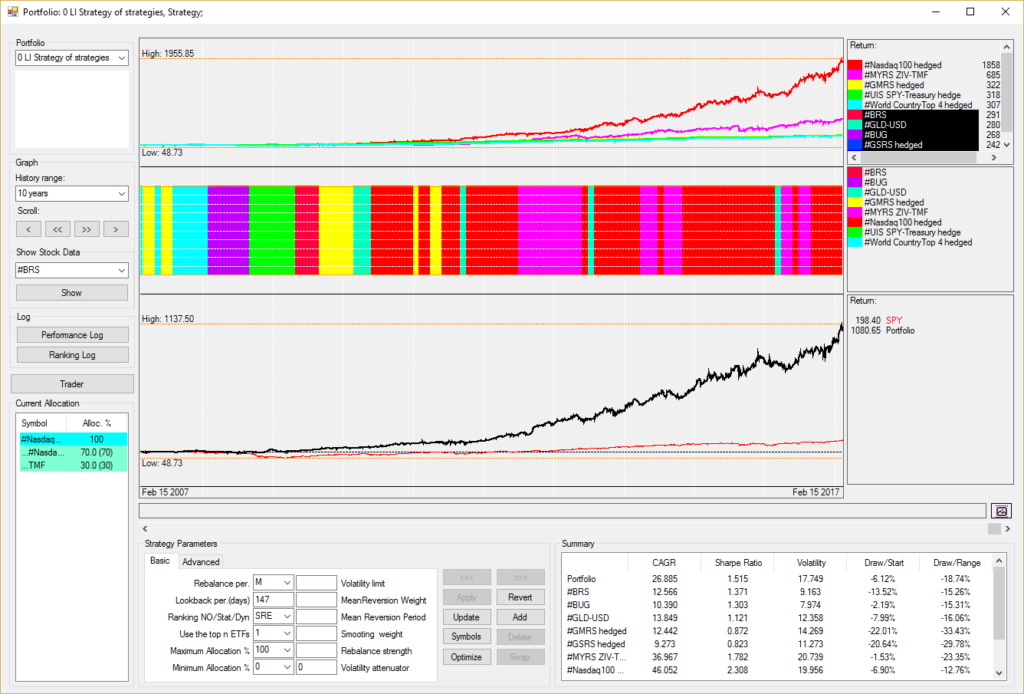

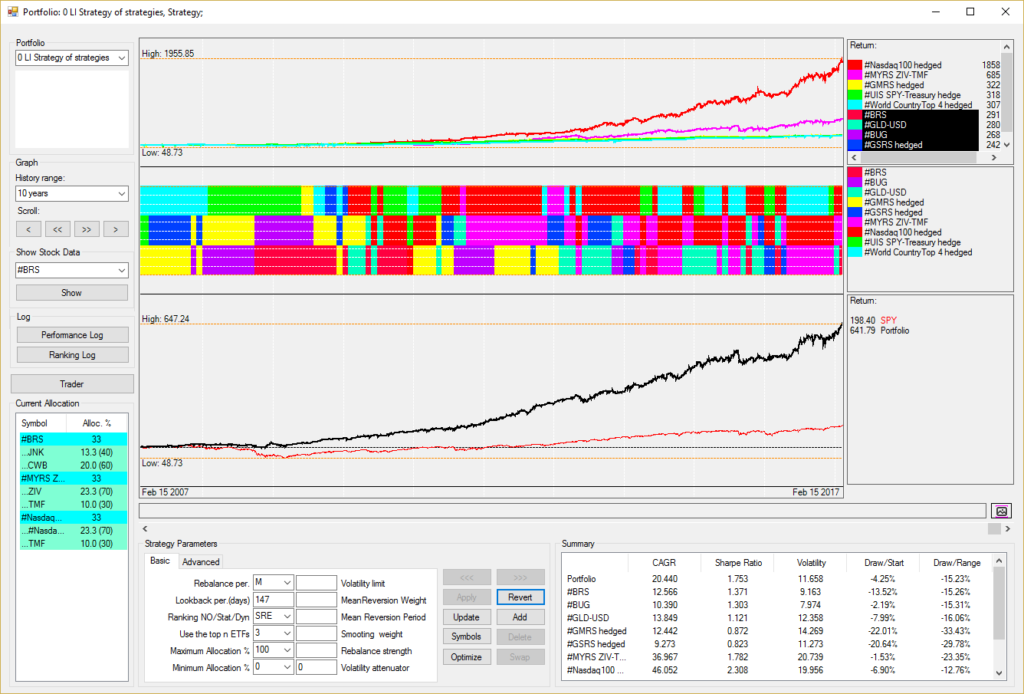

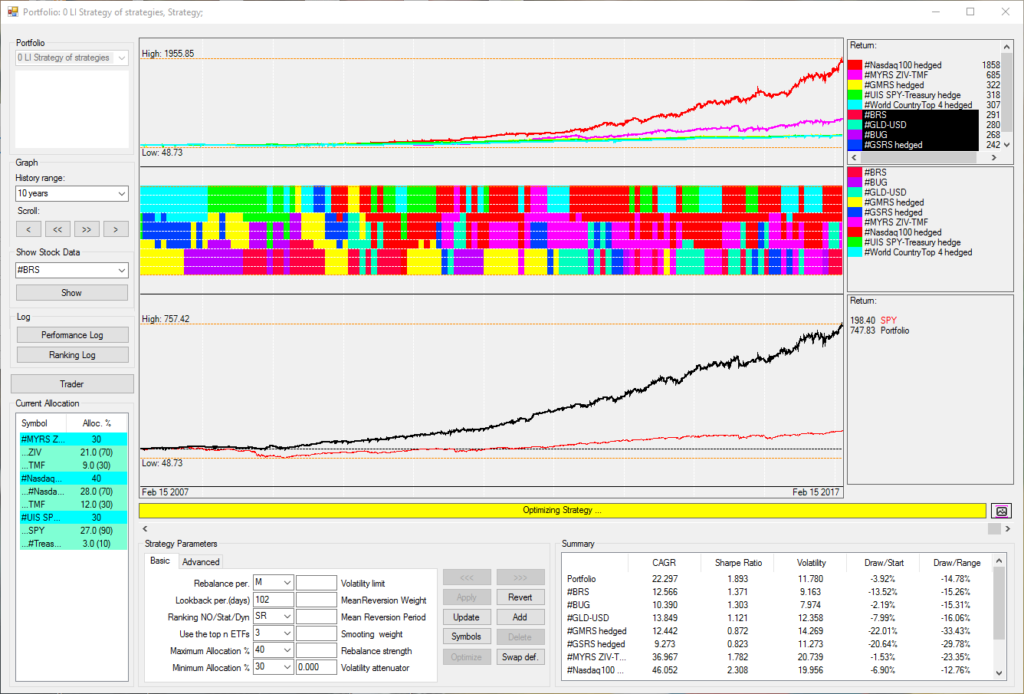

I modelled this quickly in QuantTrader, following the “Strategy of Strategies” approach we introduced in QuantTrader in the last version. Here the results of choosing the top performing strategies, in the columns the Top N Strategies we invest in, and in the rows the lookback we use, that is for how many months the strategy must be on top of the list. I use color-coding to highlight the highest annual return (CAGR) and Sharpe Ratio (Risk/Return):

Please note I´m not including the 3 times leveraged Universal Investment Strategy for two reasons: First, including a well-performing leveraged strategy would tilt the allocations towards it, and being invested with a substantial allocation in a three times leveraged strategy is not a wise investment. Second, not all of our subscribers can or would invest into such a leveraged strategy.

To pick an example for illustration, having invested during the last 10 years in Strategy which had been performing best during the last 7 months would have resulted in a CAGR of 26% with a Sharpe Ratio of 1.6. Investing in the best three strategies of the last 7 months would have led to an annual return of 20.4%, but increased the risk/return to 1.8.

Which is better? In the detailed charts below you can see that selecting the Top1 leads to problems. When using the top performing ETFs strategy from the last month we would change allocations very abruptly from one strategy to another, “strategy hopping” if you like – this leads to high transaction costs, causes whipsaws and stress. With longer lookback periods, we´d invest more and more solely into the most aggressive strategies, namely Nasdaq 100 and Maximum Yield – not a safe approach under diversification aspects.

Holding always the Top three strategies leads to better results in terms of risk/return. While also causing a long list of ETF to be reallocated each month, it reduces volatility and drawdowns to lower “10s” and leads to Sharpe Ratios of 1.6 to 1.8 – much better for most investors.

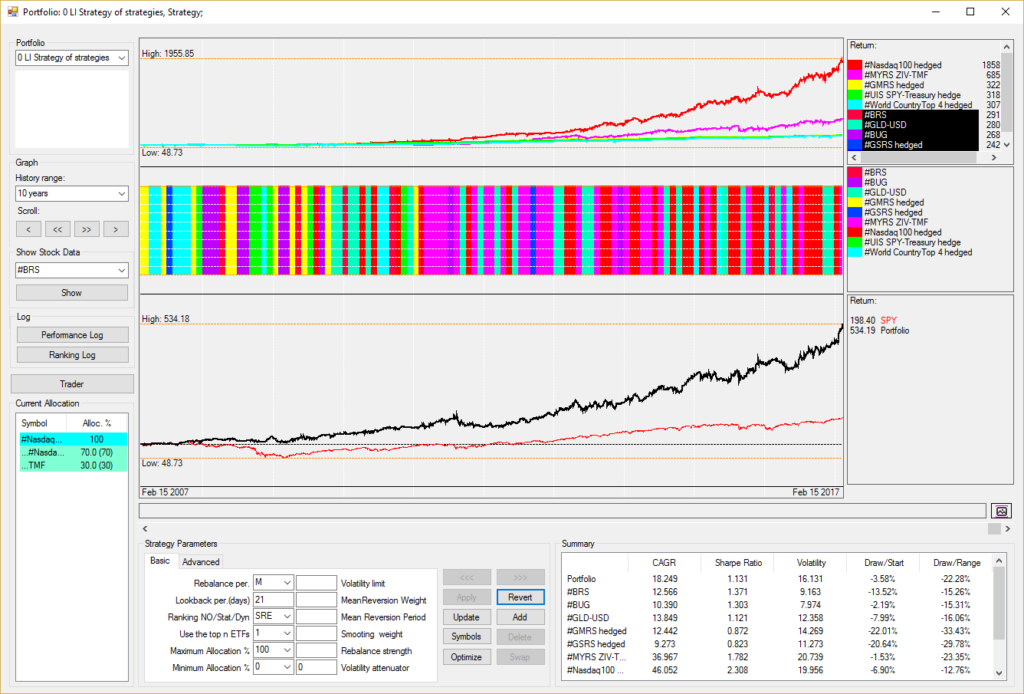

Yet the best approach for these Top N strategies is to model your own portfolio with the strategies you prefer due to their fundamental composition, and allocate among them dynamically using our QuantTrader. A quick example without further optimization is given also in the table above. We still pick the Top N performers, but now let the allocations flow freely between 40 and 60%. This enables the model to use also the correlation between the strategies to optimize the allocations, an element we ignore when using fixed weight like in the approach mentioned before.

QuantTrader beats each single Top N strategy by several percentage points – with a relatively simple approach not making use of the more advanced features we had presented in the webinar. If you are interested in learning more about QuantTrader you can still use the free-trial.

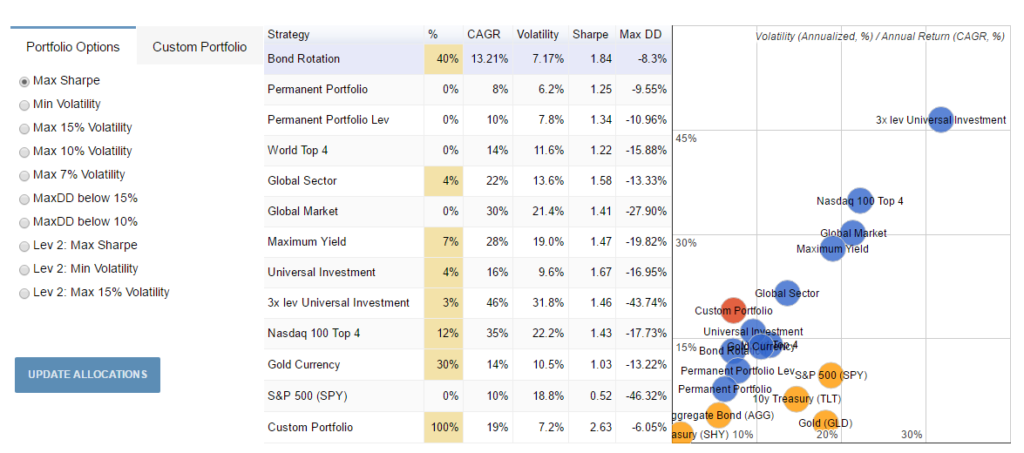

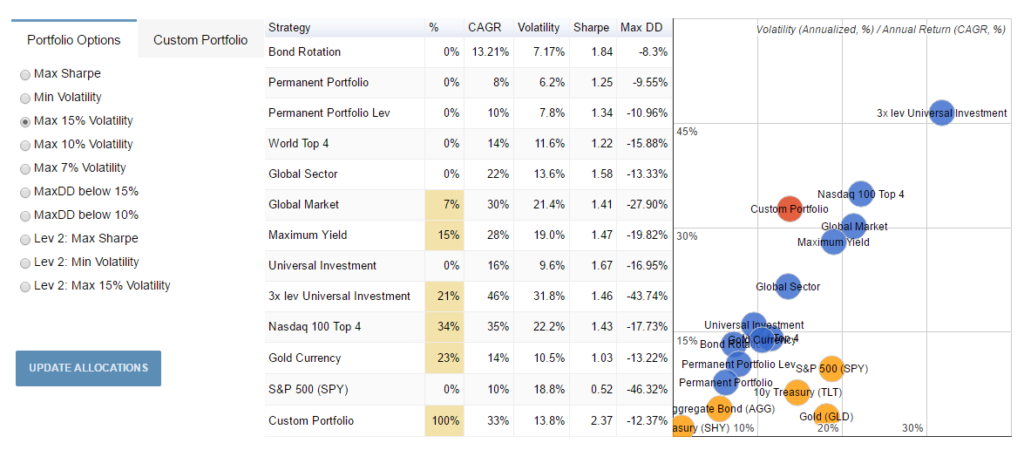

Interesting enough, none of these “Top N” portfolios can beat the Markowitz optimized options we offer in our Portfolio Builder. For example, the Maximum Sharpe Portfolio offers an historical CAGR of 19%, but a much higher Sharpe Ratio of 2.6. The more aggressive Portfolio limited to a 15% Volatility had returned a CAGR of 33% while the Sharpe Ratio of 2.37 is still way higher than any of the Top N. This can be explained by the more balanced allocations among strategies based on the co-variance and less whipsaw effects from the frequent rebalancing.

In conclusion, choosing the Top performing ETFs strategies of the last months in an equal allocation mechanism is an interesting approach from a theoretical approach. But in practice whip-saw effects and sub-optimal equal weight allocation causes the portfolios to perform much less than the Portfolio Builder or advanced QuantTrader portfolios.

If there is interest in such portfolios we can certainly make these available in an easy-to-use format. Please let us know either in the comments or by e-mail.

In anticipation of a vivid discussion as always, and a big thanks to John L. for the great question!

Alexander Horn

Gentlemen, thank you for the continued research and white-papers. In this recent post you mention “Interesting enough, none of these “Top N” portfolios can beat the Markowitz optimized options we offer” and I wonder if you plan to introduce a “Markowitz Optimized Strategy of Strategies” as a separate subscription. I will be interested in that. Thank you, Michael H.

Michael, I referred to the portfolio options from our Portfolio Builder, see here: https://logical-invest.com/strategies/custom-portfolio-builder/ or Excel version: https://logical-invest.com/wp-content/csvrepository/Portfoliobuilderexcel_Latest.zip

In these we combine our strategies into portfolios by using different optimizations and constraints like Maximum Sharpe, Minimm Volatility and limits on volatility level.

Here some posts where I introduce the functionality:

https://logical-invest.com/portfolio-builder-update-january-2017/

https://logical-invest.com/correlation-still-grand-lady-portfolio-diversification/

https://logical-invest.com/portfollio-builder-excel/

https://logical-invest.com/new-fixed-weight-portfolio-optimization/

You can also do your own blends by either trying different % allocations online or optimize by your own constraints in the Excel version (bit geeky though). You need a subscription to our all strategies bundle to get the monthly signals, see here: https://logical-invest.com/rent-a-strategy/subscribe-to-all-strategies/

Appreciate the reply, thank you.